La boussole de vos investissements

Portfolio Arbiter

Le logiciel qui vous accompagne dans la gestion de votre portefeuille d'investissement

Bien plus qu'un tableur !

Empiler des titres, de l'immobilier, des options ou des ETF dans votre portefeuille n'a pas de sens.

Chaque achat doit correspondre à une stratégie claire, que vous avez définie et formalisée. Portfolio Arbiter vous permet de répartir votre capital en stratégies dans lesquelles vous placez vos allocations et positions conformément à votre choix d'investissement

Vous pouvez avoir le même titre dans plusieurs stratégies, avec des règles d'entrée et de sortie différente.

Chez votre broker, vous n'e voyez qu'une ligne, alors qu'il y a en a plusieurs dans la vision par stratégie.

Répartir par stratégie

Groupez vos titres par stratégies et analysez vos rendements avec précision.

Cette organisation vous apporte du sens, car elle reflète vos investissements classés par les stratégies et allocations, que vous avez créés.

Chaque stratégie dispose de son propre cash en plusieurs devises.

Chaque transaction augmente ou diminue le solde correspondant.

La valeur réelle d’une stratégie correspond à vos investissements plus le cash associé.

Tout est automatiquement converti dans votre monnaie de référence pour faciliter la comparaison et l’analyse

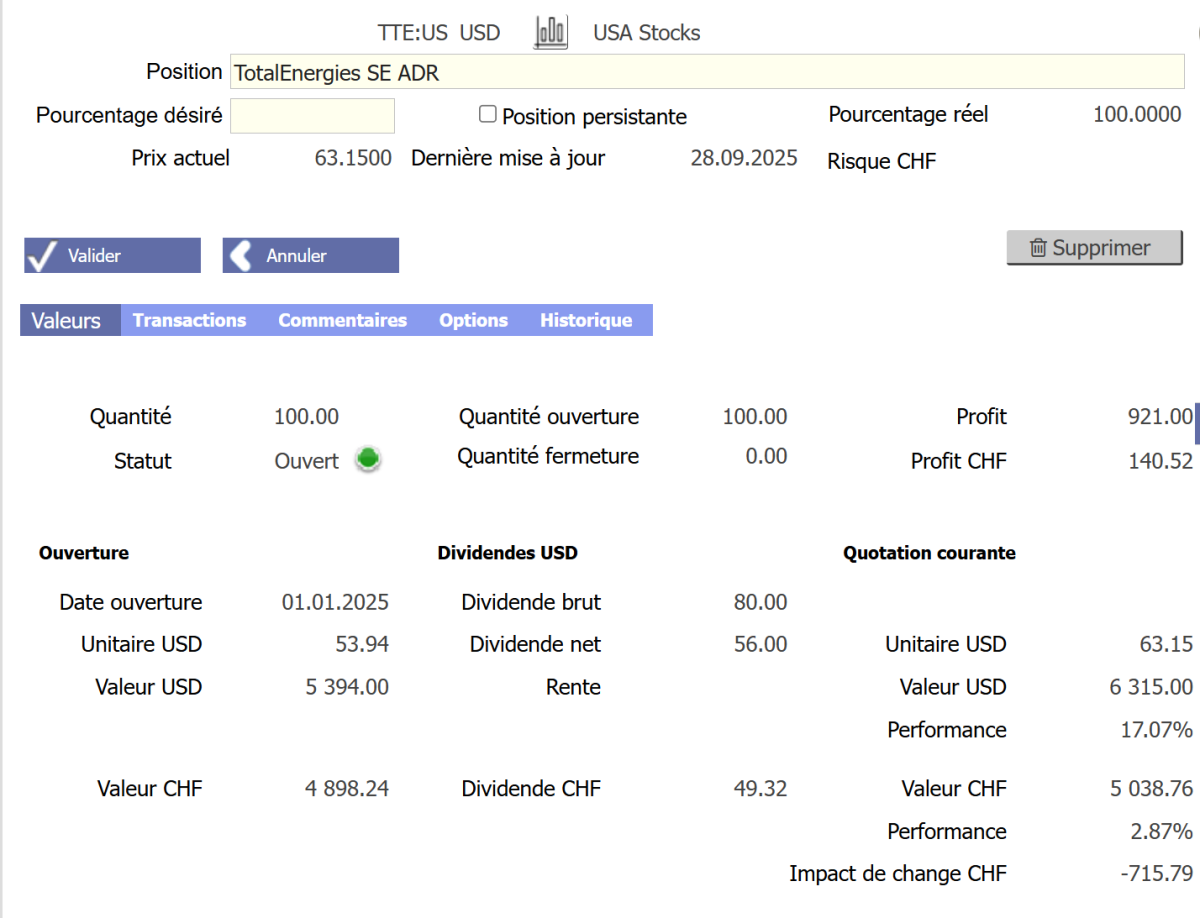

Une positon

Une position correspond au bien que vous détenez, qui est le résultat de toutes vos transactions sur ce titre.

Vous bénéficiez d’une vision condensée de la position, incluant l’impact du taux de change depuis votre première transaction.

Exemple : un achat en dollars a impacté votre marge de 715 CHF.

Vous bénéficiez d’une vision condensée de la position, incluant l’impact du taux de change depuis votre première transaction.

Exemple : un achat en dollars a impacté votre marge de 715 CHF.

Les transactions

Une position regroupe toutes les transactions liées à un titre dans la stratégie choisie.

Vous pouvez combiner actions, options, dividendes, rentes, etc.

Le prix d’achat est recalculé dynamiquement à chaque transaction.

Ainsi, un dividende ou une vente de call couvert réduit automatiquement votre prix d’acquisition.

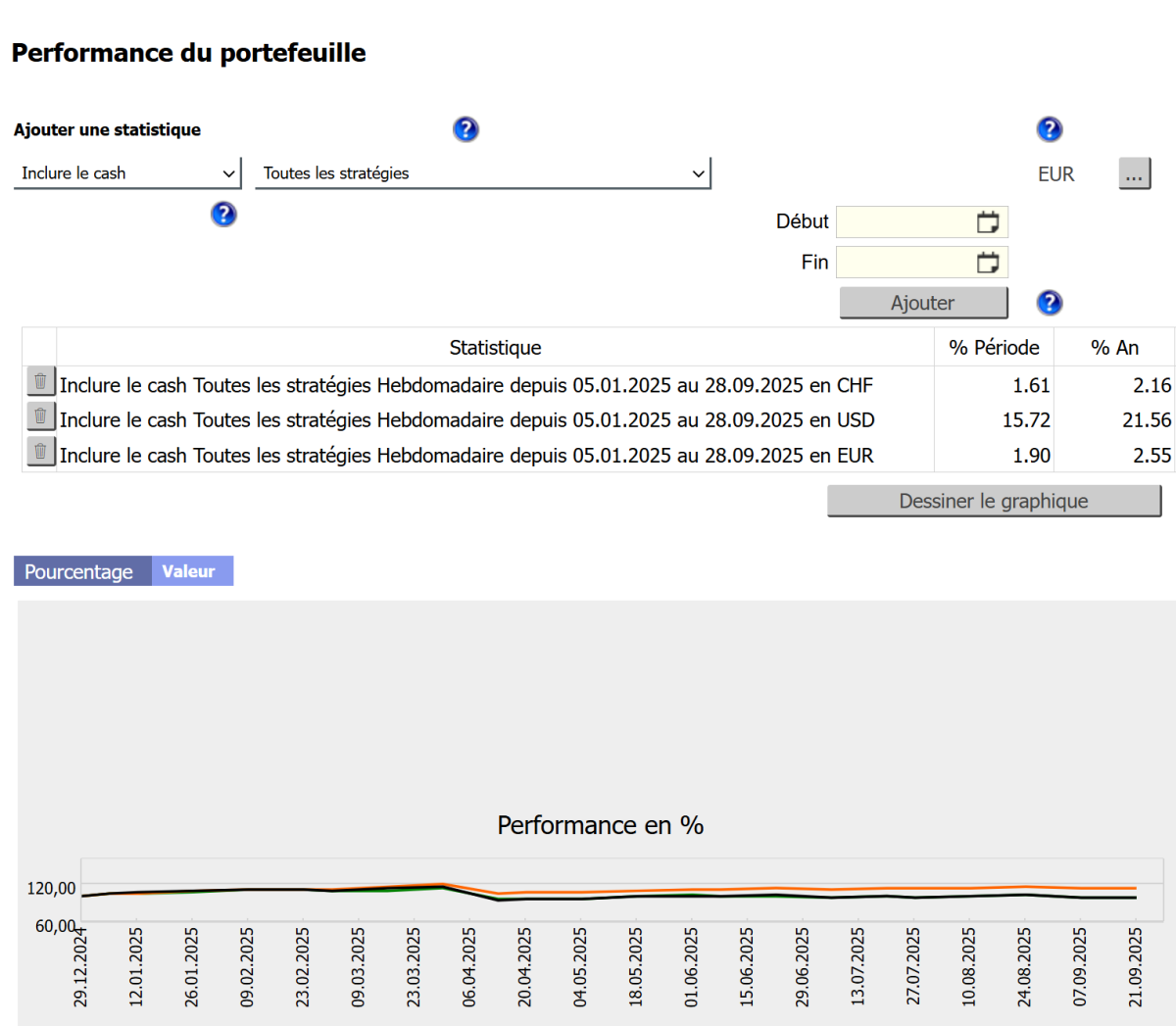

Votre vrai rendement

Le tableur donne un rendement biaisé : il se limite à la moyenne des performances de vos positions, sans intégrer l’effet des variations de change ni la réalité du capital mobilisé.

Le capital dormant ou non exploité est ignoré, ce qui réduit en fait votre rendement réel.

Comparez vos rendements par devise et mesurez l’impact des taux de change sur votre portefeuille.

Contrairement à votre courtier, Portfolio Arbiter convertit chaque transaction au taux en vigueur le jour où elle a eu lieu, et non simplement vos profits en monnaie de référence.

Comme vous affectez une partie précise de votre capital à chaque stratégie, vous pouvez calculer le rendement exact de chacune d’elles.

Votre rendement global correspond ainsi à la somme de toutes vos transactions, pondérée par le capital alloué et les taux de change du jour.

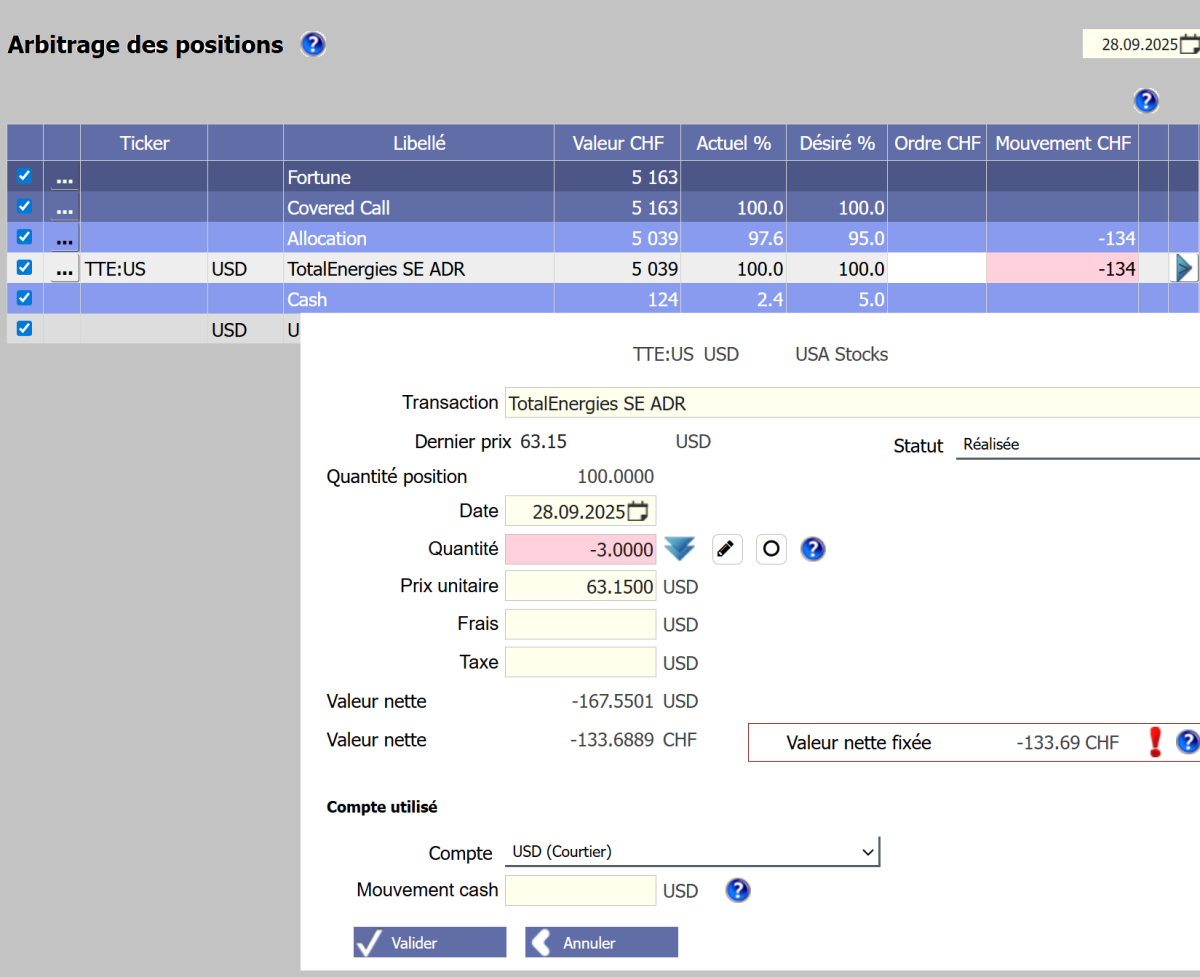

L'arbitrage

Portfolio Arbiter vous permet de définir des répartitions cibles pour vos stratégies, allocations et positions.

La page d’arbitrage calcule automatiquement les montants à acheter ou à vendre pour rétablir l’équilibre souhaité.

Tous les montants sont convertis dans votre monnaie de référence pour une cohérence parfaite.

En cliquant sur la flèche, vous ouvrez la fenêtre de transaction : il vous suffit d’ajuster le prix actuel et la quantité, puis de réaliser l’opération chez votre courtier.

Notez le prix exact et les frais pour chaque transaction.

Faites cela pour toutes les lignes et, à la fin, votre portefeuille est intégralement rééquilibré. En pratique, un arbitrage s’effectue généralement une à quatre fois par an.